Why do all cryptocurrencies rise and fall together

Mining pools are groups of miners who pool their resources (hash power) to increase their chances of winning block rewards. When the pool successfully finds a block, the miners in the pool share the reward according to the amount of work they each contributed lucky tiger casino app.

If Bitcoin in 2140 essentially serves as a store of value rather than for daily purchases, then it’s still possible for miners to profit—even with low transaction volumes and the disappearance of block rewards. Miners could charge high transaction fees to process high-value or large batches of transactions, with more efficient “layer 2” blockchains like the Lightning Network working with the Bitcoin blockchain to facilitate daily bitcoin spending.

Every time new miners join the network and competition grows, the hashing difficulty increases, which prevents the average block time from decreasing. Conversely, if many miners leave the network, the hashing difficulty decreases, making it easier to mine a new block. These adjustments keep the average block time constant, regardless of the network’s total hashing power.

Why do all cryptocurrencies rise and fall together

Although cryptocurrency is well-known for its value and the technology backing its existence, another defining characteristic is its volatility. Even when trading the largest and most established cryptocurrencies, such as Bitcoin, it isn’t rare to see crypto going up or down 5%, 10%, or 15% on any given day.

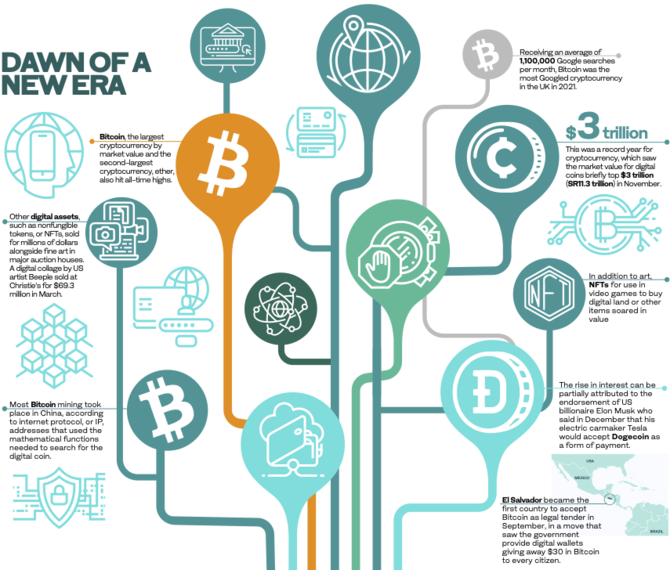

Media coverage and social media platforms have a powerful impact on cryptocurrency prices. News headlines can instill trust or fear, while social media posts often amplify market sentiment. For example, when Elon Musk added the Bitcoin hashtag to his Twitter bio, bitcoin’s price surged from $32,000 to $38,000 within hours. This demonstrates how influential figures and platforms can sway investor behavior.

However, not all policies lead to positive outcomes. When countries attempt to ban or heavily regulate cryptocurrencies, the market often reacts negatively. Political instability can also drive investors toward bitcoin as a safe-haven asset, causing fluctuations in its value. These examples highlight how closely the cryptocurrency market is tied to government decisions.

Although cryptocurrency is well-known for its value and the technology backing its existence, another defining characteristic is its volatility. Even when trading the largest and most established cryptocurrencies, such as Bitcoin, it isn’t rare to see crypto going up or down 5%, 10%, or 15% on any given day.

Media coverage and social media platforms have a powerful impact on cryptocurrency prices. News headlines can instill trust or fear, while social media posts often amplify market sentiment. For example, when Elon Musk added the Bitcoin hashtag to his Twitter bio, bitcoin’s price surged from $32,000 to $38,000 within hours. This demonstrates how influential figures and platforms can sway investor behavior.

Are all cryptocurrencies based on blockchain

Stablecoins are cryptocurrencies designed to maintain a fixed value by being pegged to traditional assets like fiat currencies. They offer stability in a market known for volatility, making them ideal for trading, transferring value, and preserving capital. Although built on blockchain networks, stablecoins are more commonly used for practical financial purposes rather than speculative investment.

Since a block can’t be changed, the only trust needed is at the point where a user or program enters data. This reduces the need for trusted third parties, such as auditors or other humans, who add costs and can make mistakes.

Blockchain and DLTs could create new opportunities for businesses by decreasing risk and reducing compliance costs, creating more cost-efficient transactions, driving automated and secure contract fulfillment, and increasing network transparency. Let’s break it down further: