This will ensure that your client’s records will accurately reflect what those funds are for in the IOLTA account. MyCase provides trust account reports so you can reconcile your firm’s trust retainer accounts — and remain compliant with state law. Chart of Accounts SampleA sample chart of accounts generally shouldn’t be copied directly into your law firm accounting software without some customization. List of AccountsThe list of accounts is a hierarchical outline of the firm’s financial accounts, grouped at the top level by assets, liabilities, equity accounts, revenue, and expenses. Your firm’s chart of accounts will have several sub-accounts under each of the top-level groups, often with their own sub-accounts.

Assets

Likewise, if the law firm experiences a period of low cash flow, it may be able to use its assets as collateral to secure a line of credit or other form of short-term financing. In this article, we will explore the Chart of Accounts used in legal accounting, including assets, liabilities, equity, revenue, and expenses. An example specific to law firms would be the sub-account of segregated liabilities. Under the heading of segregated liabilities, your chart of accounts should include pooled trust accounts and separate, interest-bearing trust accounts.

- On August 29, 2024, during after-market hours, Elastic issued a press release announcing its financial results for the first quarter of its FY 2025.

- Once you understand the basics, consider hiring an accountant, either as a contractor or as an employee.

- CPA Practice Advisor has products that deliver powerful content to you in a variety of forms including online, email and social media.

- While you will need to customize your firm’s chart of accounts to the specifics of your situation, there are several common factors for all legal practices to consider.

- Downtown Dallas also has residential offerings in downtown, some of which are signature skyline buildings.

Final thoughts on accounting and bookkeeping best practices

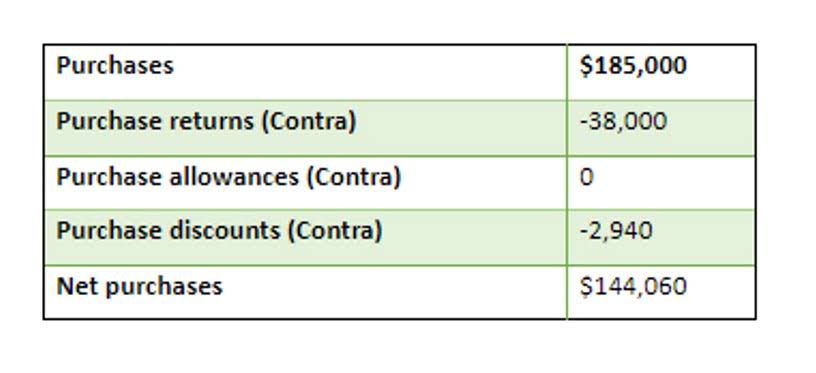

Book your demo today to see how Clio Accounting can manage your bookkeeping and accounting from the same place you manage everything else for your firm. Poor accounting practices, such as struggling to track billable hours or sending out invoices late, can lead to money leakage. Equity represents the value left in your firm after all liabilities are subtracted from your assets. It reflects the firm’s ownership value and can fluctuate depending on the firm’s profits, losses, or any distributions made to the firm’s owners. In simpler terms, equity is what you own (assets) minus what you owe (liabilities). In the next section, we’ll walk you through how to set up this system effectively, ensuring compliance in bookkeeping for lawyers like yourself.

Expenses

This ensures accurate financial recording, streamlined reporting, and better insights into profitability. By addressing these requirements from the outset, your chart of accounts becomes a powerful tool for financial management and decision-making. A well-structured chart of accounts is the backbone of efficient financial management and reporting within a law firm. By establishing a clear hierarchy based on account types, such as assets, liabilities, revenue, and expenses, it provides a standardized framework for recording and classifying financial data. As a lawyer, you know that setting up a legal chart of accounts is essential for managing your law firm’s finances.

- As a legal-specific tool, financial performance can be segmented by lawyer, office, practice group, or other custom filters.

- Your liability account will have sub-accounts for current, segregated, and long-term liabilities.

- A law firm chart of accounts serves as a comprehensive list of all of a legal practice’s financial accounts.

- Specifically, your firm needs software that can properly handle retainer funds, from the initial deposit through the transfer of earned funds into the operating account.

- Use software such as Clio Manage to help track your billable time, expenses and revenue.

- That structure is essential for tracking account balances, producing correct income and balance statements, and maintaining proper documentation for your law firm’s tax deductions.

Accounting terms you need to know

You can go with an accrual or cash accounting method in the US, and the difference is mostly about timing. Get expert bookkeeping with a 30-day free trial—no commitment, just accurate books, timely reports, and unlimited support. Intuitive legal practice features to help large-sized firms attain peak efficiency. CaseFox helps solo practitioners in improving their legal services with robust features. BlackCloak designed its enhanced family office services for multi-generational family offices – administrators and family members – including critical product and service capabilities, with packaging and pricing tailored for this specialized audience. If the firm is not profitable or barely profitable, you could use the income statement to help identify what changes should be made.

If you’re the owner of a small law firm, you need to know the essentials of bookkeeping and accounting for law firms. This way, your firm can stay compliant with ethics rules—and you can ensure you aren’t Bookkeeping for Veterinarians leaving money on the table. A chart of accounts (COA) is a blueprint for organizing every financial transaction that happens in your law firm.

Reverchon Park

- Although some of Dallas’s architecture dates from the late 19th and early 20th centuries, most of the notable architecture in the city is from the modernist and postmodernist eras.

- For example, an error in inputting a single transaction can throw off the entire balance of the ledger, making it difficult to reconcile accounts.

- Several of Downtown Dallas’s largest buildings are the fruit of this boom, but over-speculation, the savings and loan crisis and an oil bust brought the 1980s building boom to an end for Dallas as well as its sister city Houston.

- If your firm pays that bill with a credit card instead, the transaction would involve a credit to the credit card account on the liability side, plus a debit to utility expense.

- After setting up the chart of accounts, the next step is to create a general ledger.

- Accounting for law firms lets you collect and analyze information, and make data-driven decisions based on what money comes in and leaves your firm, so it’s worth it to pay attention.

This is a list of all your firm’s financial accounts, giving you a framework for where to record every transaction. Without proper attorney bookkeeping, it’s impossible to track contra asset account what money is coming (and leaving your firm). This can cause serious issues and stunt your firm’s growth (more on that later). Legal bookkeepers and legal accountants work with your firm’s financials, with the shared goal of helping your firm financially grow and succeed.

.jpg)

.jpg)

.jpg)